knoxville tn sales tax rate 2019

Submit a report online here or call the toll. 24638 per 100 assessed value county property tax rate.

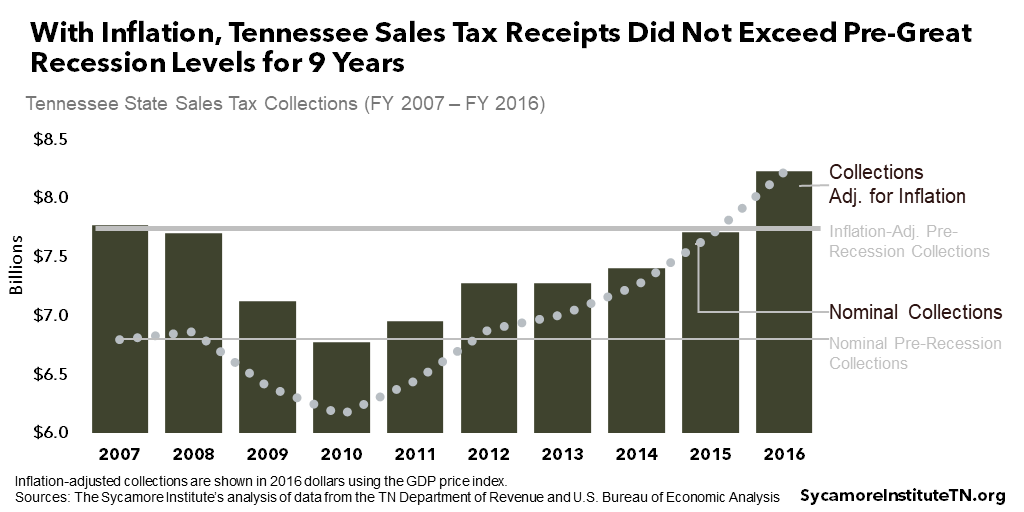

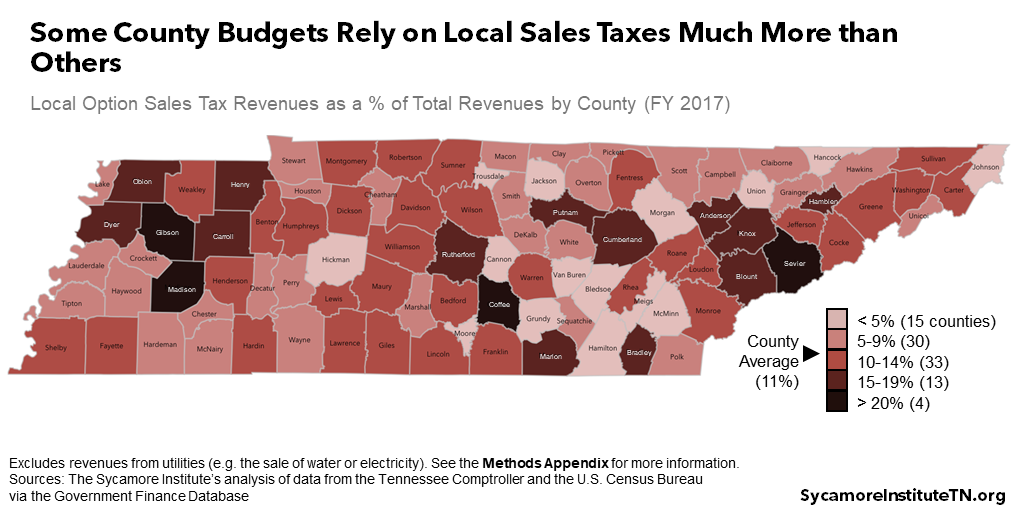

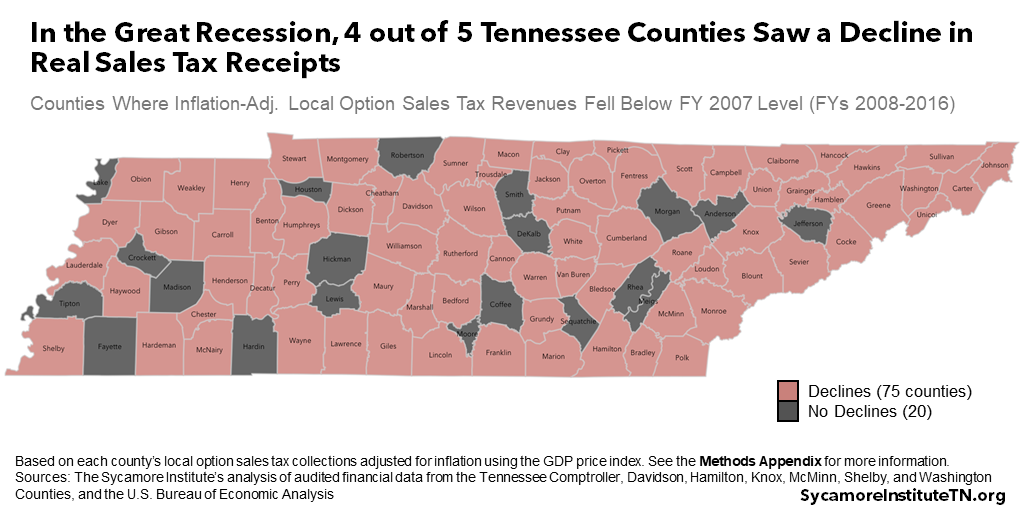

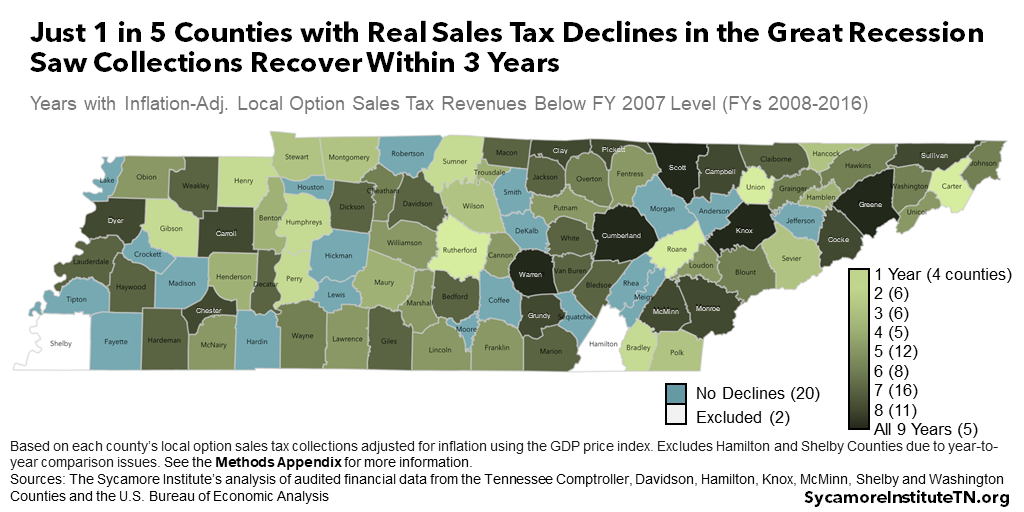

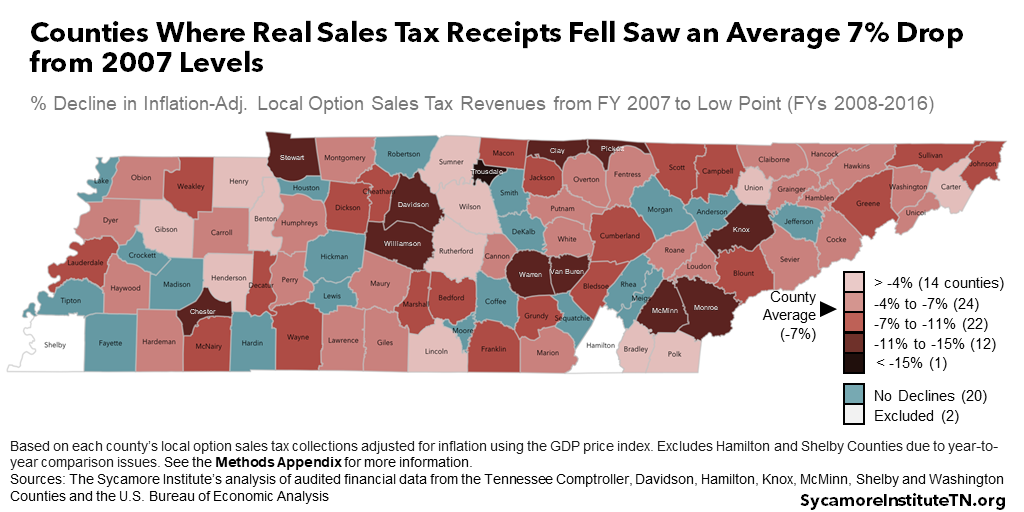

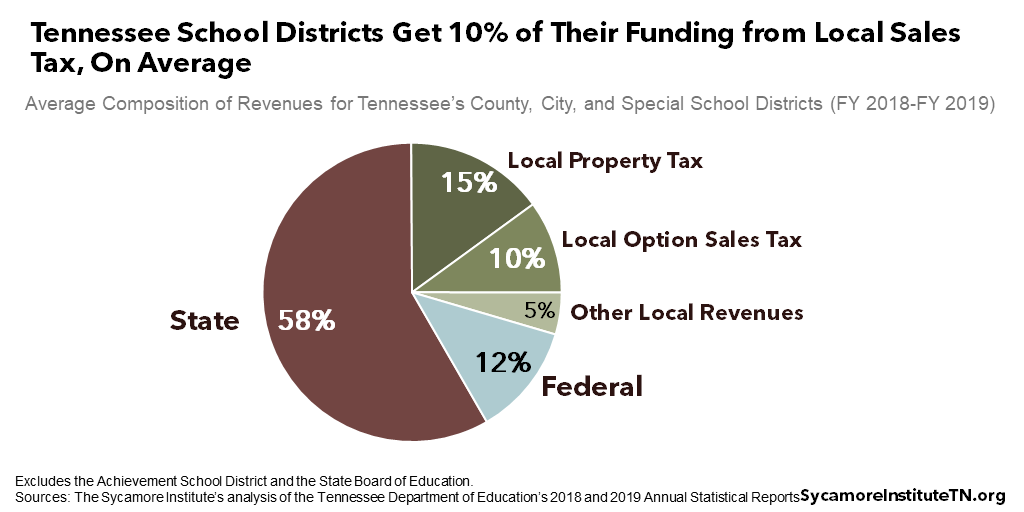

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Knoxville Tn Sales Tax Rate 2019.

. 212 per 100 assessed value. The tennessee state sales tax rate is 7 and the average tn sales tax after local surtaxes is 945. Purchases in excess of 1600 an additional state tax of 275 is added up to a.

County of Knoxville where a parcel is unfit for occupation or use and thus the sale of these parcels may also be subject to any and all such costs and expenses incurred by the City and County of Knoxville to the extent applicable. On the day of the sale the Clerk and Master of Chancery Court will conduct an auction on behalf of the City of Knoxville selling each property individually. Above 100 means more expensive.

The 925 sales tax rate in knoxville consists of 7 tennessee state sales tax and 225 knox county sales tax. About our Cost of Living Index. Real property tax on median home.

Murfreesboro TN Sales Tax Rate. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Our premium cost of living calculator includes state and local income taxes state and local sales taxes real estate transfer fees federal state and local consumer taxes gasoline liquor beer cigarettes corporate taxes plus auto sales property and registration taxes and an online.

2019 Tennessee Property Tax Rates. Within Knoxville there are around 31 zip codes with the most populous zip code being 37918. Lebanon TN Sales Tax Rate.

31 rows Johnson City TN Sales Tax Rate. 67-6-102 67-6-202 Sales or Use Tax The sales or use tax is a combination of a state tax 7 and a local option tax which varies from 150 to 275 imposed by city andor county governments. Tennessee is ranked 1348th of the 3143 counties in the United States.

Memphis TN Sales Tax Rate. The average cumulative sales tax rate in Knoxville Tennessee is 925. Tennessee Sales and Use Tax County and City Local Tax Rates County City Local Tax Rate Effective Date Situs FIPS Code County City Local Tax Rate Effective Date Situs FIPS Code Anderson 275.

The high bid today may be raised by ten percent 10 within the next ten 10 days or by Friday September 27 2019. In addition to no state income tax the overall property tax rates are on the lower end. Knoxville TN Sales Tax Rate.

The minimum combined 2022 sales tax rate for Knoxville Tennessee is 925. This tax is generally applied to the retail sales of any business organization or person engaged. Morristown TN Sales Tax Rate.

Maryville TN Sales Tax Rate. CountiesJurisdictions 2015 CTR 2016 CTR 2017 CTR 2018 CTR 2019 CTR 2020 CTR. 4 rows Rate.

This is the total of state county and city sales tax rates. The Knox County sales tax rate is. Kingsport TN Sales Tax Rate.

There is no applicable city tax or special tax. 100 US Average. For tax rates in other cities see Tennessee sales taxes by city and county.

This is the total of state and county sales tax rates. The Clerk and Master will open the bidding process with the total due on the property for delinquent taxes through the 2012 tax year interest penalty fees and other cost associated. 072 of home value.

Knoxville is located within Knox County Tennessee. Current Sales Tax Rate. Yearly median tax in Knox County.

You can print a 925 sales tax table here. Approximately 264 Million is collected from the Student Programs and Services Fee annually. This includes the sales tax rates on the state county city and special levels.

24638 per 100 assessed value County Property Tax Rate. Knox County collects on average 072 of a propertys assessed fair market value as property tax. Local collection fee is 1.

The 2018 United States Supreme Court decision in South Dakota v. For questions regarding the below rates or about the certified tax rate process please contact the offices of the State Board of Equalization. This amount is never to exceed 3600.

Taxes in Knoxville Tennessee are 62 cheaper than Nashville-Davidson Tennessee. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. The Tennessee state sales tax rate is currently.

Tennessee has 779 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Below 100 means cheaper than the US average. Did South Dakota v.

Local Sales Tax is 225 of the first 1600. The County sales tax rate is 225. The Tennessee sales tax rate is currently 7.

The median property tax in Knox County Tennessee is 1091 per year for a home worth the median value of 152300. 8 rows Tennessee has a 7 sales tax and Knox County collects an additional 275 so the minimum. Tennessee Sales Tax Rates I know Knoxville isnt New York but I expected more things to be open 247 or at least open late.

What is the sales tax rate in Knox County. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975. ANDERSON Charleston Tiptonville South Pittsburg Selmer South Fulton Lenoir City SEQUATCHIE Covington Johnson City.

Sales Tax State Local Sales Tax on Food. The minimum combined 2022 sales tax rate for Knox County Tennessee is. County City SpecialSchoolDistrict CountyRate CityRate SpecialSchoolDistrictRate Total Jurisdiction TaxYear.

The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and 225 Knox County sales tax. State Capitol Nashville TN 37243-9034 6157412775 To Report Fraud Waste Abuse. The Knoxville sales tax rate is 0.

La Vergne TN Sales Tax Rate. Sales or Use Tax Tenn. The sales tax rate does not vary based on zip code.

State Sales Tax is 7 of purchase price less total value of trade in. 925 7 state 225 local City Property Tax Rate. 05 lower than the maximum sales tax in TN.

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Alabama Sales Tax Rates By City County 2022

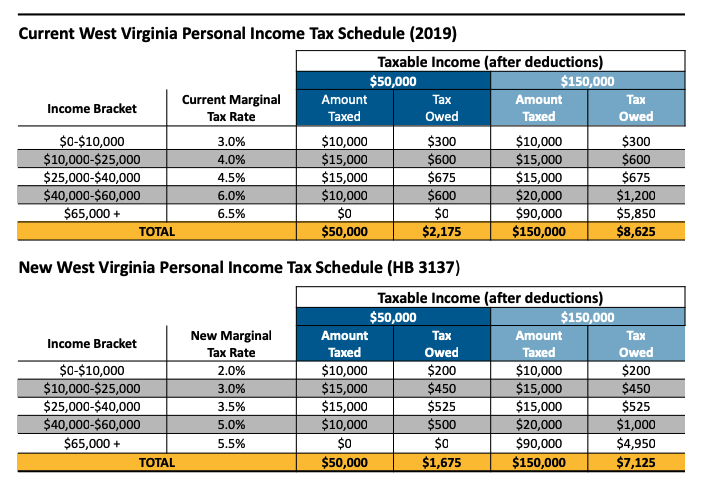

House Income Tax Cut Plan Mostly Benefits Wealthy And Puts Large Holes In The State Budget Hb 3137 West Virginia Center On Budget Policy

1559 Laurens Glen Ln Knoxville Tn 37923 Mls 1086055 Zillow Dream House Plans House Styles Home Inspector

Georgia Sales Tax Rates By City County 2022

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Histogram Of Sales Tax Revenue Total State Revenue For The 50 Download Scientific Diagram

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Traditional Finances City Of Conroe

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Sales Tax On Grocery Items Taxjar

Year Specific Tax Rate Elasticities And Internet Penetration Rates Over Download Scientific Diagram

Traditional Finances City Of Conroe

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

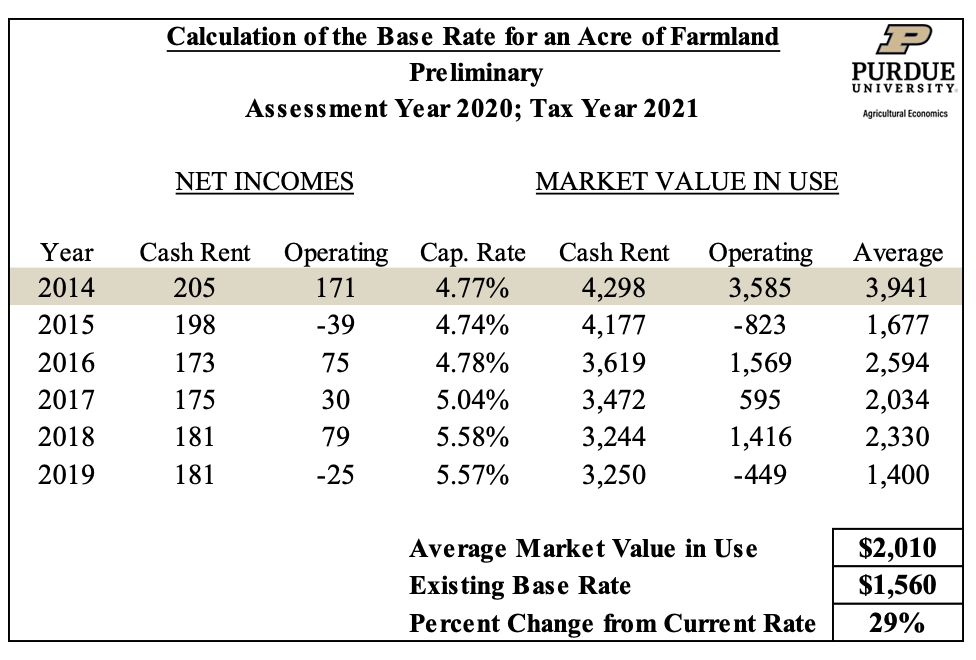

Farmland Assessments Tax Bills Purdue Agricultural Economics

Estate Tax Department Of Taxation

Tennessee Sales Tax Rates By City County 2022

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue